On March 25, the United States, Russia, and Ukraine issued separate statements announcing key agreements on the safety of commercial shipping in the Black Sea. Despite differences in the parties' formulations, the core consensus included a ban on the threat of force against merchant ships, the prevention of the militarization of merchant ships, and the cessation of attacks on energy facilities.

The official website of the U.S. White House has issued two separate statements on the U.S. delegation's talks with Russia and Ukraine. In the statement concerning Russia, the White House said that the United States and Russia agreed to work together to ensure the safety of navigation in the Black Sea, to prohibit the use of force in the area, and to prevent commercial vessels from being used for military purposes. The United States will assist in restoring global market access for Russian agricultural and fertilizer products, reducing related maritime insurance costs, and improving port clearance and payment system support. The parties will also develop specific measures to implement the agreement on a ban on attacks on Russian and Ukrainian energy facilities.

The Russian statement noted that Russia and the United States have agreed to promote the implementation of the Black Sea Initiative, which includes ensuring the safety of navigation in the Black Sea, prohibiting the use of force, preventing the use of merchant vessels for military purposes and conducting inspections of relevant vessels.

However, the Russian side has set preconditions, including: lifting sanctions on the Agricultural Bank of Russia and other financial institutions involved in international trade in grain (including fish products) and fertilizers, reintegrating them into the SWIFT system, and opening relevant accounts; lifting restrictions on trade financing operations; lifting sanctions on export enterprises involved in the production of grain (including fish products) and fertilizers, and removing restrictions on the relevant insurance companies; lifting Restrictions and sanctions on port services for Russian ships involved in trade in grain (including fish products) and fertilizers; lifting of restrictions on the supply of Russian agricultural machinery, and restrictions on the supply of materials related to the production of grain (including fish products) and fertilizers.

The agreement is seen as the most substantial diplomatic breakthrough since the Russian-Ukrainian conflict, and could even become the cornerstone of a comprehensive ceasefire.

For the global dry bulk market, the potential normalization of Black Sea shipping would reshape the grain, fertilizer and coal trade landscape. But whether the market can truly benefit remains dependent on three main variables: whether geopolitical risks are materially reduced, whether Russian export sanctions are loosened, and whether key demand-side players such as China can boost imports.

Bilal Muftuoglu, head of dry bulk research at Howe Robinson Partners, said that the most immediate effect of the Black Sea agreement is likely to be a boost to shipowners' confidence in calling at Russian and Ukrainian ports, with some Western operators still avoiding the region. However, he emphasized that Ukraine's grain exports have basically returned to pre-war levels, and the agreement's boost to total dry bulk trade may be limited.

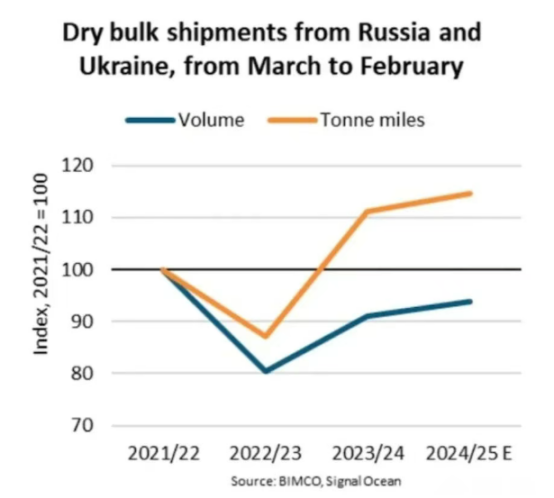

Three years after the outbreak of the Russia-Ukraine war, total dry bulk traffic between the two countries is still 6% below pre-war levels, according to a BIMCO report at the end of February. However, over the past 12 months, the trend in dry bulk transportation between the two countries has been diametrically opposed, with Ukrainian shipments surging 87% year-on-year while Russia's are down 6% year-on-year.

The main reason for the surge in Ukrainian freight traffic is the success of its coastal corridor. Since August 2023, Ukraine has been exporting dry bulk cargoes through this coastal corridor, which proved to be an effective solution despite Russian attacks on ships in September and October 2023. However, cargo volumes are still 36% lower than before the war.

“If a sustainable peace agreement is reached, Ukrainian crop acreage may expand and corn exports may grow.” Muftuoglu added.

As for the Russian grain trade, traditional buyers in the Middle East, North Africa and East Africa have always maintained stable purchases, and the war has not caused any substantial supply cuts. However, he pointed out that the real impact of the dry bulk market is the key variable in the Russian harvest, “to significantly boost trade volumes, need to wait for the lifting of sanctions on Russian coal.”

During the first two years of the war, Russian dry bulk shipping was less affected and even grew due to increased fertilizer and grain exports. However, over the past 12 months, Russian coal exports have fallen by 11% and grain exports by 2%, leading to a decline in overall exports. Russian coal accounts for 50 percent of the total freight traffic between the two countries.

According to Wilson Wirawan, head of dry bulk research at BRS Shipbrokers, despite the positive picture on the supply side of volumes, “the market ultimately depends on demand-side performance”.

Citing data that global grain loadings have slumped 11.5% year-on-year so far in 2025, with total seaborne grain shipments edging up only 0.7% last year, and Chinese imports shrinking even more, he said, “If Chinese purchases fail to pick up in 2025, any supply-side improvement will have little effect.”

In addition to food, the fertilizer trade could be in for a major shake-up, with Muftuoglu predicting a ceasefire or a surge in Russian fertilizer (especially potash) exports to the U.S. - which is currently imposing tariffs on Canadian potash.

Another potential change is that the EU may reassess its position on taxing Russian fertilizer imports. on March 14 the European Council just passed a motion to impose tariffs on the remaining Russian and White agricultural products and some nitrogen fertilizers, covering a 15% share of Russian agricultural imports (based on 2023 data).

www.yukonlog.com

SHENZHEN YUKON LOGISTICS CO.,LTD.

+ There are no comments

Add yours