In the realm of business, the decision to structure your enterprise as a sole proprietorship or a partnership is a critical one. This decision can significantly impact various aspects of your business, including liability, taxation, and management. This article aims to provide a comprehensive comparison between these two business structures, helping entrepreneurs make an informed decision.

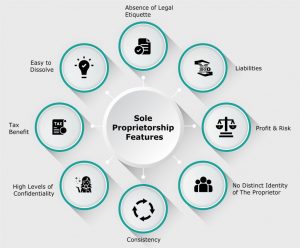

A sole proprietorship is the simplest form of business structure, where one individual owns and operates the entire business. On the other hand, a partnership involves two or more individuals who share the ownership and operation of the business.

- Liability:

In a sole proprietorship, the owner has unlimited liability. This means that in case of business debts or legal issues, the owner's personal assets can be used to settle them. Conversely, in a partnership, the liability is shared among the partners. However, in a general partnership, partners are still personally liable for business debts. Limited partnerships can offer limited liability protection, but they require at least one general partner with unlimited liability.

- Taxation:

Sole proprietors report business income and expenses on their personal income tax return. This is known as pass-through taxation and can be simpler than corporate tax returns. Partnerships also benefit from pass-through taxation, but the partners must file an informational return for the partnership, and each partner reports their share of income or loss on their personal tax return.

- Management and Decision Making:

In a sole proprietorship, the owner has complete control over the business decisions. However, in a partnership, decision-making is shared, which can lead to disagreements. A well-drafted partnership agreement can help mitigate these issues by outlining decision-making processes and dispute resolution methods.

- Continuity and Transferability:

A sole proprietorship ceases to exist upon the owner's death or decision to sell. However, a partnership can continue to exist beyond the withdrawal or death of a partner, depending on the terms of the partnership agreement.

- Funding:

Sole proprietorships may struggle with funding as they cannot sell stock and lenders may be hesitant to extend credit to a business without a separate legal identity. Partnerships may have greater access to funding as they can attract investors with the promise of shared profits.

In conclusion, the choice between a sole proprietorship and a partnership depends on the individual circumstances and goals of the entrepreneur. It is advisable to consult with a business advisor or attorney to understand the implications of each structure.

+ There are no comments

Add yours