In the world of business, the terms sole proprietor and self-employed are often used interchangeably. However, while they may seem synonymous, they represent different facets of business ownership. This article aims to dissect the differences between a sole proprietor and a self-employed individual, providing a comprehensive understanding of these two business classifications.

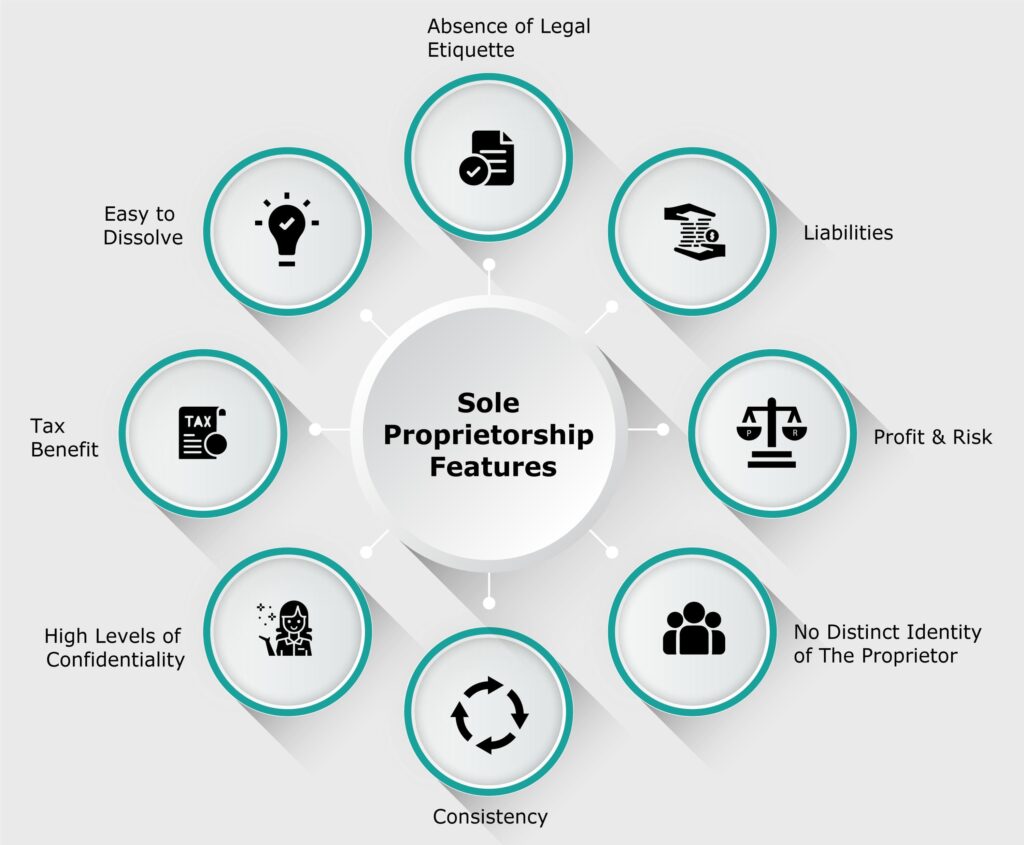

A sole proprietorship is the simplest form of business structure. It refers to a business owned and operated by one person, with no legal distinction between the owner and the business entity. The owner is entitled to all profits and is responsible for all the business's debts, losses, and liabilities.

On the other hand, being self-employed means working for oneself rather than an employer. Self-employed individuals can operate a business, work as independent contractors, or engage in freelance work. They earn income directly from their clients or customers, rather than receiving a salary or commission from an employer.

One of the primary differences between a sole proprietor and a self-employed individual lies in the scope of their operations. A sole proprietor owns a business, while a self-employed person may or may not own a business. For instance, a freelance graphic designer or a consultant is self-employed but does not necessarily own a business.

Another key difference is in terms of liability. In a sole proprietorship, the owner's personal assets can be used to pay off business debts or liabilities since the business and the owner are legally the same entity. However, self-employed individuals who operate as independent contractors or freelancers have a degree of separation from their business activities, which can offer some protection against business-related liabilities.

Taxation is another area where differences emerge. Sole proprietors report business income or losses on their personal income tax returns. In contrast, self-employed individuals are required to pay self-employment tax, which covers Social Security and Medicare taxes, in addition to income tax.

In terms of business operations, a sole proprietor has complete control over the business, including decision-making and management. Self-employed individuals, especially those working as freelancers or independent contractors, may have more flexibility in choosing their projects or clients but may also face more uncertainty in terms of income stability.

In conclusion, while there are overlaps between being a sole proprietor and a self-employed individual, the differences lie in the nature of business ownership, liability, taxation, and operational control. Understanding these differences is crucial for anyone considering venturing into the world of self-employment or starting a sole proprietorship. It allows for informed decision-making, ensuring the chosen path aligns with one's professional goals and personal circumstances.

+ There are no comments

Add yours